Essentials for Small Businesses in Bookkeeping 18332147629

Effective bookkeeping is essential for the financial health of small businesses. It involves understanding basic concepts, tracking key financial statements, and managing expenses. Regular financial reviews are critical for maintaining accuracy and compliance. Each of these components plays a significant role in informed decision-making. As small businesses navigate these complexities, the impact on their operational efficiency and growth potential becomes increasingly apparent. Exploring these fundamentals reveals the pathways to success.

Understanding Basic Bookkeeping Concepts

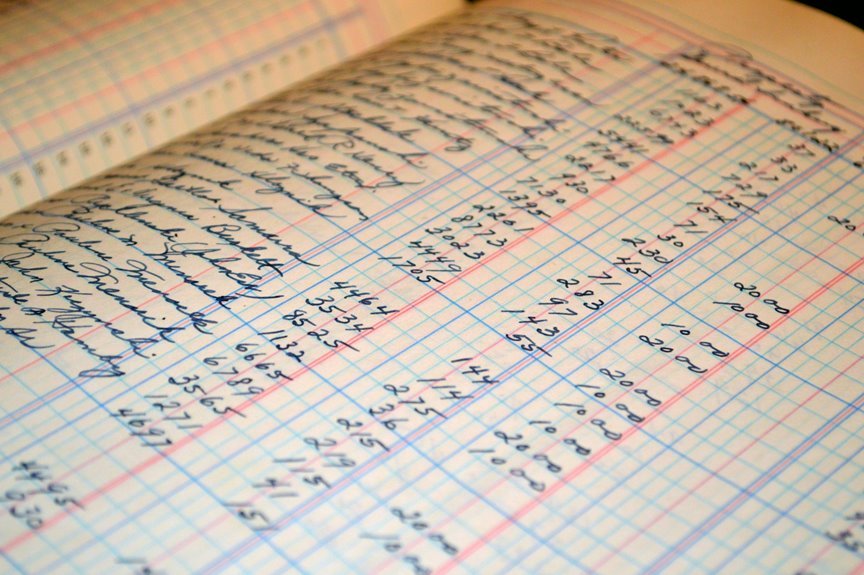

Bookkeeping serves as the backbone of small business financial management, encompassing a systematic approach to recording and organizing financial transactions.

Understanding basic bookkeeping concepts involves familiarizing oneself with essential bookkeeping terminology and adhering to fundamental accounting principles.

This knowledge empowers business owners to maintain accurate records, ensure compliance, and ultimately achieve financial clarity, fostering a sense of freedom in their entrepreneurial endeavors.

Key Financial Statements Every Business Should Track

Financial statements are critical tools that provide a comprehensive overview of a business’s financial health.

Key statements include the profit and loss statement, which details revenues and expenses, and the cash flow statement, highlighting cash inflows and outflows.

Together, these documents enable business owners to make informed decisions, ensuring sustainable growth and financial freedom, while effectively managing resources.

Effective Expense Management Techniques

Maintaining a clear picture of financial health is not solely reliant on tracking key financial statements; effective expense management is equally vital for the sustainability of small businesses.

Implementing robust expense tracking systems enables businesses to monitor spending patterns, while diligent budget forecasting helps anticipate future financial needs.

Together, these techniques empower small businesses to make informed decisions, ensuring long-term viability and operational freedom.

The Importance of Regular Financial Review and Reconciliation

Although many small businesses prioritize expense management, the importance of regular financial review and reconciliation cannot be overstated.

Such practices enable accurate financial forecasting and enhance cash flow management. By systematically evaluating financial statements, businesses can identify discrepancies, optimize resource allocation, and make informed decisions.

Ultimately, these processes empower small business owners to maintain financial health and sustain their operational freedom.

Conclusion

In the intricate tapestry of small business management, effective bookkeeping serves as the foundational thread that weaves together financial clarity and operational success. By mastering essential concepts, tracking key financial statements, and employing rigorous expense management, business owners can navigate the complexities of their financial landscape. Regular reviews act as a compass, guiding them toward informed decisions and sustainable growth, ultimately transforming their ventures into resilient enterprises capable of weathering economic fluctuations.